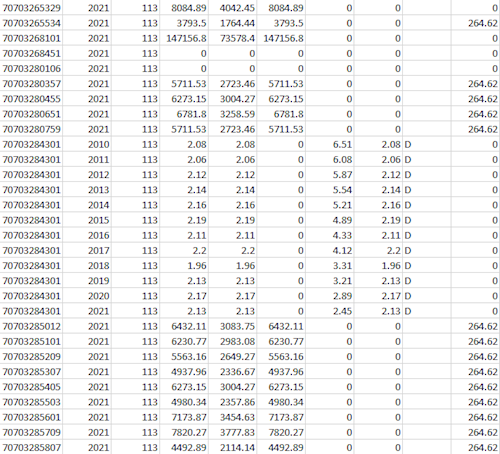

Information on this page is to assist professionals and others working with paying property taxes.

PLEASE NOTE:

PLEASE NOTE:

DANE COUNTY TREASURER

CITY-COUNTY BUILDING, RM 114

210 MARTIN LUTHER KING JR BLVD

MADISON, WI 53703

PLEASE NOTE: